Inflation Targeting Doesn't Exist

I promise this is not just another “please support NGDP targeting” post.

If you ask the average economist about the history of monetary policy, they will tell you a story about how the world of the 19th century revolved around a gold standard, which partially caused the Great Depression. They will then mention Bretton-Woods and explain how the discretionary policies of the 70s caused an inflationary crisis. Finally, they will point to inflation targeting as essentially the “End of History” for monetary policy. Ever since New Zealand adopted it in 1990, it has become the default rule for central banks, often with a 2% target.

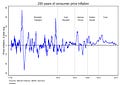

In fact, by all means, inflation targeting appears to have been a smashing success. Just one look at Intergralds’ graph of inflation in the United States should make it clear just how much inflation has stabilized compared to other points in history.

Nevertheless, there remains opposition to inflation targeting. Most famously, a group of economists called Market Monetarists have continued to claim that inflation targeting is inferior to nominal GDP targeting. Their primary argument is that inflation targeting calls for 2% inflation regardless of what happens to the supply-side of the economy. Therefore, sometimes an oil shock might cause prices to rise too quickly, prompting tight monetary policy to get down to 2% inflation. NGDP targeting, on the other hand, would not call for tightening during an oil shock since supply shocks raise prices and lower real GDP, effectively leaving nominal GDP unchanged (or close to unchanged). A clear example of when inflation targeting can go wrong would be 2008, when an oil shock led central banks to worry about inflation instead of the budding financial crisis. As a result, the European Central Bank actually raised interest rates and made the crisis much, much worse. In contrast, NGDP was not rising above trend, and would not call for the insane policy we ended up with.

But there is a major issue with the paragraph above: it’s completely wrong. More specifically, it’s wrong in the assumption that central banks are targeting inflation.

Let’s back up. Note that, contrary to popular belief, central bankers aren’t completely stupid. Further note that the optimal target for monetary policy has been a matter of great debate for some time now. With various papers from the likes of Mankiw and some guy named Bernanke, economists understood that monetary policy should not respond to supply shocks. Bernanke makes this clear in discussion of inflation targeting:

Third, short-term inflation targets can and have been adjusted to accommodate supply shocks or other exogenous changes in the inflation rate outside the central bank's control. A model here is the Deutsche Bundesbank's practice of stating its short-term (one-year) inflation projection as the level of "unavoidable inflation."

In fact, this phenomenon has never been clearer than today, when the Bank of Canada has made it explicit that central banks are ignoring supply shocks. If a supply shock leads to an elevated price level, they don’t respond to it. In other words: CENTRAL BANKS ARE NOT TARGETING INFLATION.

I can’t make this any clearer. Inflation targeting is a misnomer. It’s misleading. There is no such thing as an inflation target.

This is also why central banks have been benign in their response to the post-pandemic inflation. They’ve mostly interpreted it as a supply shock caused by China’s lockdowns, the War in Ukraine, and more.

This in turn makes us question what the hell the Market Monetarists are on about. If the central bank is ignoring supply shocks anyway, then what’s the case for NGDP targeting?1 Hell, I support NGDP targeting, so what am I on about?

The answer is that this was never really a debate about supply shocks and NGDP vs inflation targeting. This is a debate about rules vs discretion.

Ever since Kydland and Prescott’s seminal piece on rules and discretion, economists have known that giving the central bank too much leeway will lead to adverse outcomes (such as…inflation). This is why Friedman was pushing for the Fed to essentially become a computer and it’s also the logic behind the famous Taylor Rule. Hell, a brief look at the IGM Chicago panel makes it clear that the vast majority of economists favor rules over discretion. And what’s more, it’s the primary reason people support NGDP targeting. Let me explain.

As explained a few paragraphs above, the case for NGDP targeting is that it helps ignore supply shocks. If the economy is hit with, say, an oil shock, real GDP goes down and prices go up. So NGDP won’t change too much. Ideally, it won’t change at all. But…what if it does? What if the supply shock affects prices much more than it affects real GDP?2 Then NGDP targeting won’t really be optimal. You would rather have a central bank trying to measure the extent of the supply shock and go from there. So boom! NGDP targeting is actually worse than inflation targeting because it doesn’t allow the central bank the discretion of measuring a supply shock on its own! That is, if the central bank is good at measuring supply shocks.

That is the real question. If the central bank is very good at its job, then it can make “inflation targeting” into a better version of NGDP targeting.3 But central banks, by all measures, are not very good at their jobs. In 2008 they missed a global recession and conducted excessively tight policy. In 2022, they kept rates too low for too long and caused demand-side inflation in addition to supply-side inflation. And don’t even get me started on the 70s and 1929. By all means, their discretionary powers have led to *big* problems.

And that’s where NGDP targeting comes back into the picture. It’s a decent (but imperfect!) way of making sure you don’t respond to supply shocks and does not require you to grant the central bank the power to decide how large the supply shock is. The growth rate of NGDP helps tell you that on its own. If NGDP normally grows up 4% but is now growing by 7%, it tells you that monetary policy is too loose. The central bank doesn’t measure if that’s right or wrong, and just follows the rule down to 4%.

That’s what this debate comes down to. Rules versus discretion.

Informed readers are likely yelling “LEVEL TARGETING” right now, but that is not the topic of this post.

Again, please ignore the implications of level targeting for the purposes of this post.

Sandro, wonderfully explained. It is somewhat a myth that central bankers are merely targeting inflation. Reality is more nuanced than this. Mind if we link back to you as a source on our NGDP explainer at https://www.lianeon.org/p/what-is-ngdp-targeting?utm_source=%2Finbox&utm_medium=reader2 ??